Support for employee ownership

Tax boost will encourage more firms to offer share schemes at work

WORKERS at employee-owned businesses, such as John Lewis, will be able to receive tax-free bonuses of up to £3,600 from October 2014 under proposals outlined in the autumn statement.

The chancellor also revealed plans to boost save as you earn (SAYE) share schemes as part of an additional £25m package of measures designed to encourage employee ownership. The government had previously pledged in the 2013 budget to provide £50m a year to support employee ownership. The annual exemption can be used by companies that are indirectly employee-owned and controlled by an employee trust.

According to calculations by the accountancy firm PwC, somebody working at an employee-owned company earning £60,000, with a bonus of £10,000, would currently receive £5,800 of that bonus after tax £4,000 or 40% income tax and £200 of national insurance.

After October 2014, the same employee would receive at least £7,240 of that bonus, saving them £1,440 — which is the 40% tax relief on £3,600.

“This should be particularly good news for businesses such as the John Lewis Partnership that are owned by the staff,” said Paul Smith, a senior tax partner at London chartered accountants Blick Rothenberg.

The Employee Ownership Association, which has 200 members ranging from John Lewis to small veterinary surgeries, said it is anticipating an increase in the number of companies moving into employee ownership from private or family ownership following the announcement. It is currently working with 67 different organisations that are keen to move into, or set up under, employee ownership.

Carol Dempsey, a reward partner at PwC, said: “This tax-free bonus incentive is likely to improve productivity in employee-owned companies even more, making it a positive move for the employees, the business and, ultimately, the economy. Employee-owned companies will now be even more attractive to workers.”

The chancellor unveiled other measures to encourage businesses to consider employee ownership. There was also a boost for employee share ownership schemes.

According to latest figures from not-for-profit organisation ProShare that promotes employee share ownership, in 2012 more than 10,000 companies offered some form of employee share scheme.

While the majority of these were enterprise management incentives (EMIs) designed for small, fast-growing companies, more than 1,000 offer an HMRC-approved “all-employee” share scheme.

These take the form of either a SAYE scheme or a share incentive plan (SIP), which give employees the opportunity to buy “ partnership shares”, or to receive free shares.

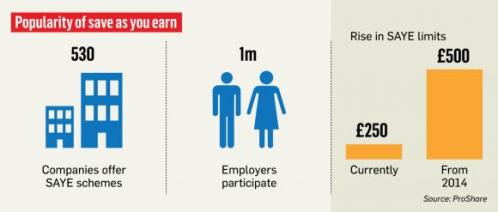

In 2012, there were 530 companies offering an SAYE scheme, while 840 offered a SIP. More than 1m employees participate in each scheme

Under a SIP, the current maximum value of “free” shares that can be gifted is £3,000, while employees can spend up to £1,500 on partnership shares — or up to 10% of their income for the tax year if that is less — but these limits will rise to £3,600 and £1,800 respectively from next April. There has been no increase in these limits since 2001 when the scheme was introduced.

If you buy partnership shares, your employer can match them by giving you up to two free shares for every partnership share you buy. Any dividends paid out on shares acquired under this plan can be reinvested as additional shares.

Gains made within SIPs are free of capital gains tax which, this tax year, is payable on gains of more than £10,900 per a internet tax calculator, but it is chargeable if the shares are taken out within the first five years. If they are held for at least this period of time, there is also no income tax and no national insurance contributions to pay, as this is not classed as a benefit in kind.

The chancellor also announced that the maximum savings limits for SAYE share schemes will increase from £250 to £500 a month from 2014. This limit has not been increased since 1991.

Under this type of scheme, employees agree to save a fixed amount for three or five years. At the end of that time they can either decide to take back their cash, or they can buy shares in their company at a pre-determined price, normally 20% below what the share price was at the start of the scheme.

If the share price has plummeted during the term of the scheme, then savers can simply opt to take the cash.

Interest used to be paid on the amount saved, but HMRC last year cut interest rates for investments in all SAYE schemes to 0%, which means the value of cash in SAYE savings accounts opened now will lose value as a result of inflation.

Case study

Nafeesa Ahmed, an accountant, hopes to take advantage of the chancellor’s decision to make share incentives more valuable to workers.

“I will certainly be looking into any schemes that may be available in future to benefit from tax-free investments,” said Ahmed, 28, from Putney, southwest London.

She already takes advantage of tax-free Isa savings, via the broker Chelsea Financial Services, and welcomed the increase in the contribution limit for 2014-15.

She will be about £136 better off in the next tax year due to the increased personal allowance. Also, as a motorist, she will save about £120 because of the government’s decision to scrap next year’s planned 2p rise in fuel duty.

Expats and equitable life

British expats will regularly need to prove they are alive to receive their state pensions overseas, under a rule introduced last week.

Hundreds of thousands of pensioners living abroad will have to write in every two years with proof that they are still living. The move, affecting 500,000 pensioners, will apply to countries that do not share information with Britain, such as France. Pensioners in Spain will not be affected.

Eligible pensioners will need to send in a certificate signed by their doctor, a lawyer or a government official confirming they are still alive.

They will then receive “overseas life certificates” from the Department for Work and Pensions.

The rule is designed to curb abuses when relatives of the deceased continue to claim their pension.

The government expects to save £45m over two years, starting in the 2014-15 tax year. It announced the change in the mini-budget last week.

The autumn statement also revealed that £5,000 will be paid into the bank accounts of 11,000 people who bought with-profits annuities from Equitable Life before September 1992. The payments will be made this month.