Snap’s $20bn flotation sparks investor stampede

Messaging app’s listing is biggest since Alibaba

The parent company of the popular messaging app Snapchat is to be valued at almost $20 billion after setting a price for its initial public offering at $17 a share.

Snap, which will begin trading later today on the New York Stock Exchange under the symbol “SNAP”, has priced its long-awaited float above the $14 to $16 a share targeted by the company, in an indication of strong investor demand. The offer was several times oversubscribed.

The board of Snap, which styles itself as a camera company, met late last night to finalise the stock price. At that valuation it is the biggest US-listed flotation since Alibaba, the Chinese ecommerce platform, in 2014 and the richest since Facebook in 2012. Last night the social media site had a value of $395 billion.

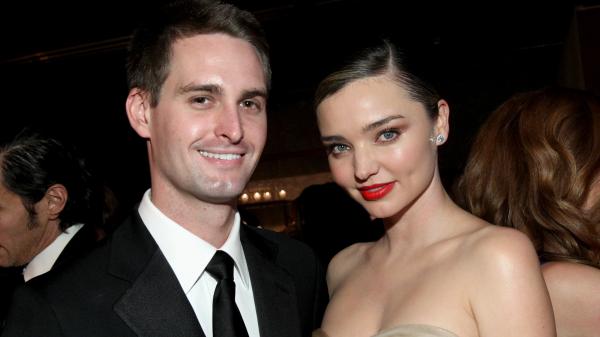

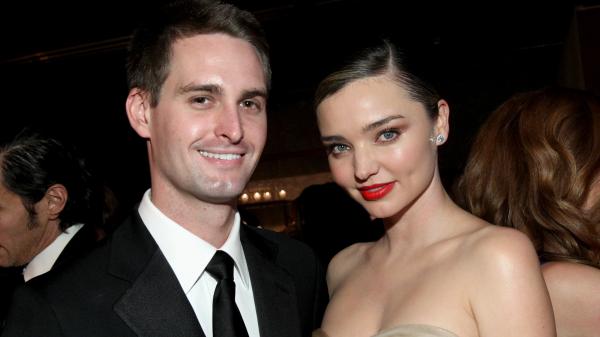

Evan Spiegel, 26, Snap’s chief executive, and his fellow co-founder Bobby Murphy, 28, chief technology officer, will have stakes valued at $4.3 billion each. They will each sell 16 million shares, earning them $272 million apiece, and will remain in control of the company.

A successful flotation by Snap is a boost for the somewhat dormant tech IPO market in the United States.

“People love the space, and it isn’t like there’s a new entrant every quarter or every year even,” Sean Stiefel, portfolio manager at Navy Capital, said.

Snap executives have travelled around the US, and visited London, to market the company to prospective investors. In January the company said: “We will bill our advertising revenue from the UK [and a few other countries] through a UK entity. This allows us to pay taxes in the UK, which we believe is part of being a good local partner as we grow our business.”

The Los Angeles-based company has said previously that about one quarter of its planned float — the total number of shares that will be sold in the offering — would be subject to a lockup of one year before they can be sold.

The Snapchat app, the core of Snap’s business, has 158 million users every day and is particularly popular among young people. Users share photos and short videos, or “snaps”, which self- destruct within a short timeframe. On average more than 2.5 billion snaps are created every day.

The company makes its money from advertising and is betting on a boom in mobile ad sales. Snap said it that generated $404.5 million in sales last year, up from $58.7 million in 2015. The company reported a net loss of $514.6 million, compared with $372.9 million previously.

Snapchat launched in September 2011 as Picaboo and renamed as Snapchat that year. The app went on to accumulate 100,000 daily users in early 2012 and a million by the end of that year. By early 2014, 50 million people were using the app every day, climbing to 100 million by the end of 2015.